How Do I Get Money?

Figuring out how to get money can be a daunting task, especially if you’re just starting out. Whether you’re looking to increase your income, find a new source of revenue, or simply manage your finances better, there are numerous strategies and methods you can employ. Let’s dive into some of the most effective ways to get money.

1. Increase Your Income

One of the most straightforward ways to get more money is to increase your income. Here are some strategies you can consider:

-

Seek a raise: If you’re employed, consider asking for a raise. Research your industry’s average salary for your position and present your employer with a well-researched case for why you deserve a pay increase.

-

Get a promotion: Aim for a higher-paying position within your company. This could involve taking on additional responsibilities or acquiring new skills.

-

Find a new job: If you’re not satisfied with your current job or if you’re looking for a higher salary, consider searching for a new job. Use job search websites, networking, and recruitment agencies to find opportunities.

-

Freelance or consult: If you have a particular skill set, consider offering your services as a freelancer or consultant. Platforms like Upwork, Fiverr, and Freelancer can help you find clients.

2. Save Money

Another way to get money is to save more of what you already have. Here are some tips to help you save money:

-

Track your expenses: Keep a close eye on your spending habits. Use budgeting apps or spreadsheets to monitor your expenses and identify areas where you can cut back.

-

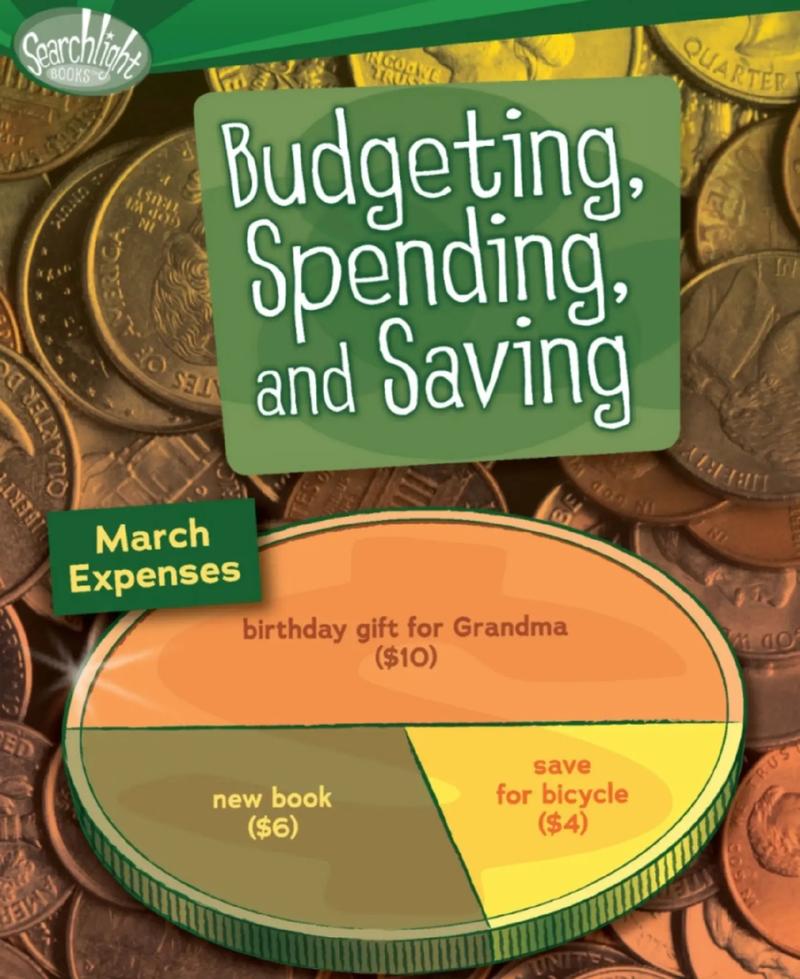

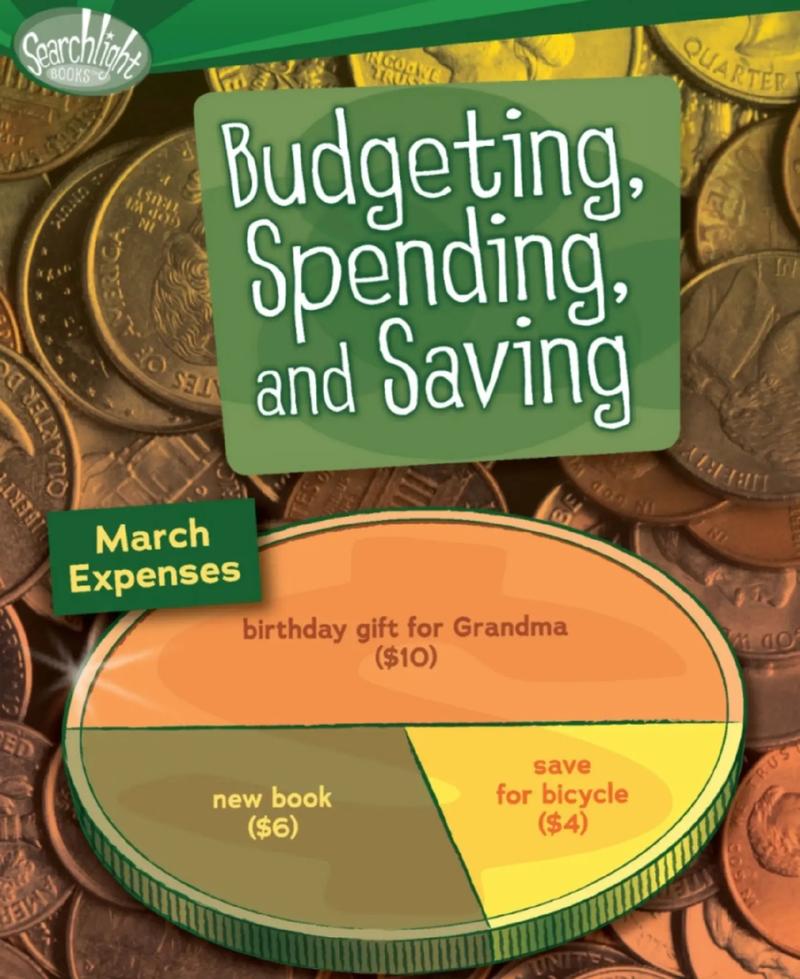

Set a budget: Create a budget that allocates funds for your needs, wants, and savings. Stick to your budget to ensure you’re not overspending.

-

Automate your savings: Set up automatic transfers to your savings account to ensure you consistently save a portion of your income.

-

Use cashback and rewards: Take advantage of cashback offers, credit card rewards, and other incentives to save money on everyday purchases.

3. Invest Your Money

Investing your money can be a powerful way to grow your wealth over time. Here are some investment options to consider:

-

Stock market: Investing in stocks can provide significant returns, but it also comes with risks. Consider consulting with a financial advisor to develop a suitable investment strategy.

-

Bonds: Bonds are a lower-risk investment that can provide a steady stream of income. They are often considered a good option for conservative investors.

-

Real estate: Investing in real estate can be a lucrative venture, but it requires a significant amount of capital and knowledge of the market.

-

Peer-to-peer lending: Peer-to-peer lending platforms allow you to lend money to individuals or small businesses in exchange for interest payments.

4. Start a Side Hustle

Starting a side hustle can be a great way to generate additional income. Here are some ideas for side hustles:

-

Online business: Create an online store, sell products on marketplaces like Etsy or eBay, or start a blog to generate income.

-

Teaching or tutoring: Share your expertise by teaching or tutoring others in your field of knowledge.

-

Writing or editing: If you have strong writing or editing skills, consider offering your services to clients.

-

Graphic design: Use your graphic design skills to create logos, brochures, and other marketing materials for clients.

5. Cut Unnecessary Expenses

Identifying and cutting unnecessary expenses can free up more money for you to save or invest. Here are some common expenses to consider cutting:

-

Subscription services: Review your subscriptions and cancel those you no longer use.

-

Luxury items: Evaluate your spending on luxury items and consider cutting back on non-essential purchases.

-

Entertainment: Look for free or low-cost entertainment options instead of spending money on movies,