Cashflow 101: Robert Kiyosaki’s Board Game – A Detailed Multi-Dimensional Introduction

Cashflow 101, created by Robert Kiyosaki, is a board game that has gained immense popularity among individuals looking to understand the basics of personal finance and investing. This game is designed to teach players about the flow of money, the importance of financial literacy, and the art of wealth creation. In this article, we will delve into the various aspects of Cashflow 101, providing you with a comprehensive overview of its gameplay, rules, and educational value.

Gameplay and Rules

The game is played on a board that consists of two main tracks: the Rat Race and the Fast Track. The Rat Race represents the traditional path of working for a salary, while the Fast Track symbolizes the path to financial freedom and wealth creation. Players start with a set amount of cash and assets, and the goal is to move up the Fast Track by investing in properties, businesses, and other income-generating assets.

Here’s a brief overview of the gameplay and rules:

-

Players roll dice to move around the board, landing on various spaces that can either generate income or incur expenses.

-

Players can buy and sell properties, businesses, and other assets to increase their income and wealth.

-

Players must manage their cash flow, paying bills, taxes, and other expenses as they arise.

-

The game ends when a player reaches the Fast Track and has accumulated a certain amount of wealth.

Components and Design

Cashflow 101 comes with a variety of components that enhance the gameplay experience. These include:

-

The board itself, with the Rat Race and Fast Track tracks, property cards, and other game elements.

-

Property cards, which represent different types of real estate investments, such as houses, apartments, and commercial properties.

-

Business cards, which represent various business ventures, such as restaurants, retail stores, and service companies.

-

Income and expense cards, which represent the cash flow generated by properties and businesses, as well as the expenses incurred by owning them.

-

Debt cards, which represent loans and mortgages that players can take out to finance their investments.

The game’s design is user-friendly and visually appealing, making it easy for players of all ages to understand and enjoy the gameplay.

Educational Value

Cashflow 101 is not just a game; it is an educational tool that teaches players valuable lessons about personal finance and investing. Here are some of the key educational aspects of the game:

-

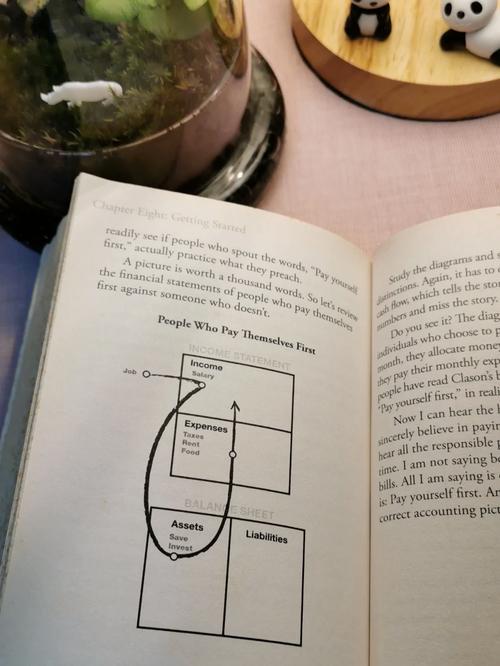

Understanding cash flow: Players learn how to manage their cash flow by balancing income and expenses, which is essential for financial success.

-

Investing in assets: The game teaches players about the importance of investing in income-generating assets, such as real estate and businesses, rather than relying solely on a salary.

-

Debt and leverage: Players learn about the risks and rewards of using debt to finance investments, as well as the importance of managing debt responsibly.

-

Financial independence: The game’s Fast Track represents the path to financial independence, teaching players the importance of building wealth and achieving financial freedom.

Real-World Applications

The lessons learned in Cashflow 101 can be applied to real-life financial situations. Here are some examples:

-

Creating a budget: Players learn how to create and stick to a budget, which is essential for managing personal finances.

-

Investing in real estate: The game’s property cards can help players understand the basics of real estate investing, such as property values, rental income, and expenses.

-

Starting a business: The business cards can provide insights into the challenges and rewards of starting and running a business.

-

Building wealth: Players learn the importance of building wealth through smart investments and financial strategies.

Conclusion

Cashflow 101