UCPath Online Earnings Statement: A Comprehensive Guide

Understanding your earnings statement is crucial for financial management and making informed decisions. In this detailed guide, we will delve into the UCPath Online Earnings Statement, exploring its various aspects and how it can help you manage your finances effectively.

What is UCPath Online Earnings Statement?

The UCPath Online Earnings Statement is a comprehensive document provided by the University of California system. It offers employees a detailed overview of their earnings, deductions, and other financial information. Accessible through the UCPath portal, this statement is designed to be user-friendly and informative.

Accessing Your Earnings Statement

Accessing your UCPath Online Earnings Statement is a straightforward process. Simply log in to the UCPath portal using your username and password. Once logged in, navigate to the “Earnings Statement” section to view your current and past statements.

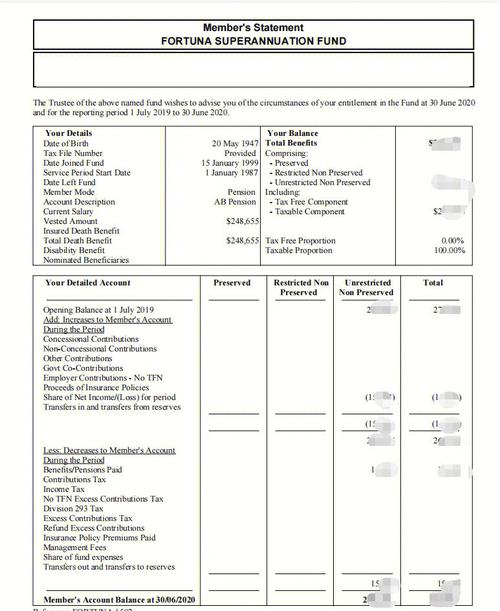

Understanding the Components of Your Earnings Statement

Your UCPath Online Earnings Statement consists of several key components, each providing valuable information about your earnings and deductions. Let’s take a closer look at each of these components:

1. Gross Pay

The gross pay section displays the total amount of money you earned before any deductions. This includes your base salary, overtime pay, and any other earnings you may have received during the pay period.

2. Deductions

Deductions are amounts subtracted from your gross pay to cover various expenses. Common deductions include federal and state taxes, Social Security, Medicare, and other voluntary deductions such as health insurance premiums and retirement contributions.

3. Net Pay

After all deductions have been applied, the remaining amount is your net pay. This is the amount you receive in your bank account or receive as a check.

4. Benefits and Allowances

This section provides information about any benefits or allowances you may be eligible for, such as health insurance, retirement plans, and paid time off.

5. Tax Information

The tax information section includes details about your federal and state tax withholdings, as well as any tax credits you may be eligible for.

Using Your Earnings Statement for Financial Management

Your UCPath Online Earnings Statement is a valuable tool for managing your finances. Here are some ways you can use it to stay on top of your financial health:

1. Budgeting

Reviewing your earnings statement can help you create a realistic budget by understanding your income and expenses. By knowing how much you earn and how much is deducted, you can allocate funds for bills, savings, and other financial goals.

2. Tracking Deductions

Monitoring your deductions can help you ensure that you are not overpaying on taxes or other expenses. If you notice any discrepancies, you can contact your employer or tax professional to address the issue.

3. Planning for the Future

Your earnings statement can provide insights into your financial progress over time. By reviewing your earnings and deductions, you can make informed decisions about saving for retirement, purchasing a home, or other long-term goals.

Common Questions About UCPath Online Earnings Statement

Here are some frequently asked questions about the UCPath Online Earnings Statement:

| Question | Answer |

|---|---|

| How often is my earnings statement updated? | Your earnings statement is updated on a monthly basis. |

| Can I print a copy of my earnings statement? | Yes, you can print a copy of your earnings statement by selecting the “Print” option in the UCPath portal. |

| What should I do if I notice an error on my earnings statement? | Contact your employer’s payroll department or the UCPath help desk to resolve any errors. |

Understanding your UCPath Online Earnings Statement is essential for managing your finances effectively. By familiarizing yourself with its components and using it as a tool for budgeting and planning, you can take control of your financial future.