Understanding PayPal’s Revenue Model

When you order something online, PayPal often appears as a convenient payment option. But how does PayPal make money from these transactions? Let’s delve into the various ways PayPal generates revenue.

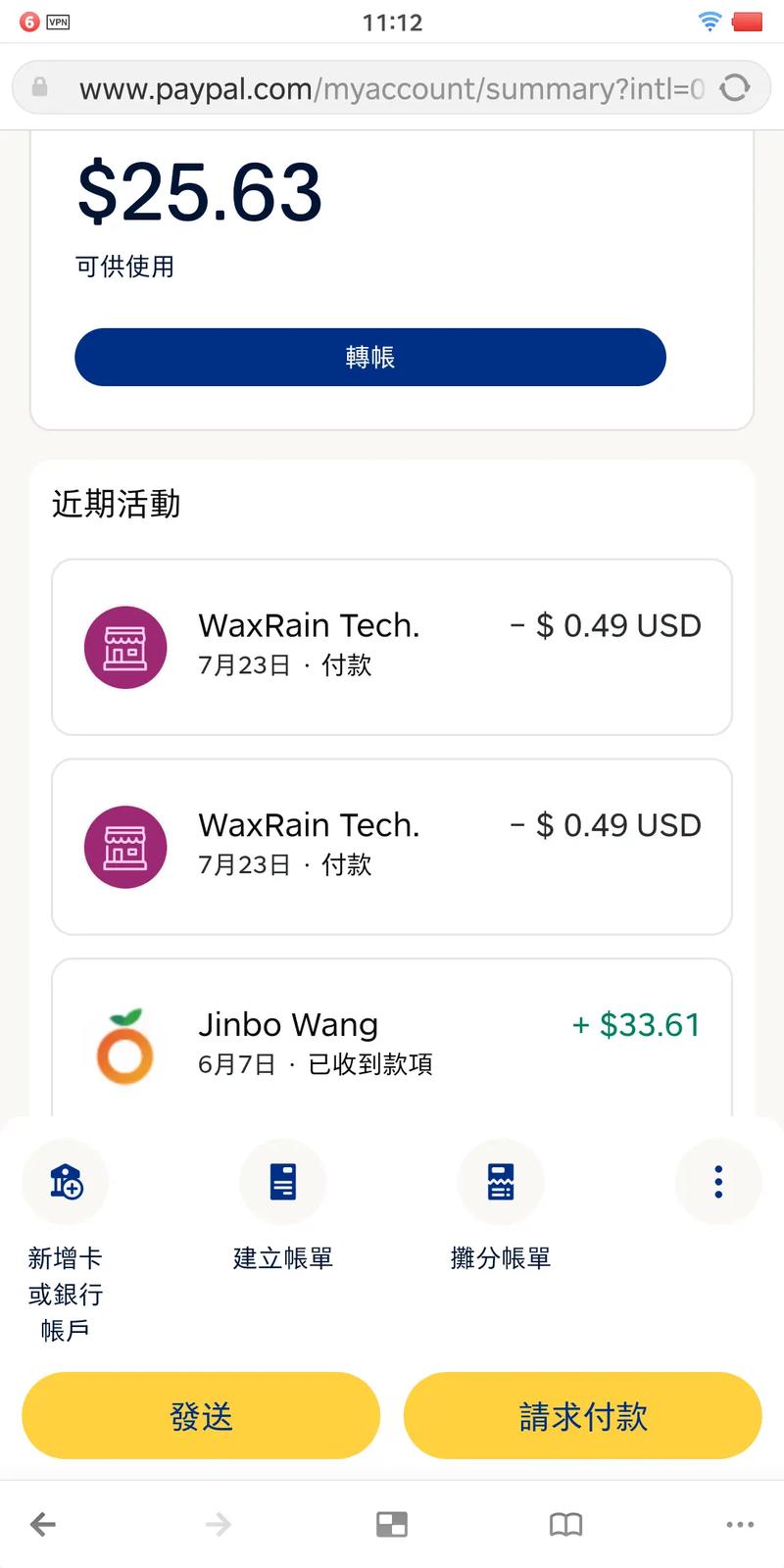

Transaction Fees

One of the primary sources of income for PayPal is transaction fees. When you use PayPal to make a purchase, the seller pays a fee to PayPal. These fees vary depending on the type of transaction and the country where the transaction takes place. For example, PayPal charges a percentage fee on the total transaction amount, which can range from 2.9% to 3.4% plus a fixed fee of 30 cents per transaction.

| Transaction Type | Fee Rate | Fixed Fee |

|---|---|---|

| Domestic Credit Card | 2.9% + 30垄 | 30垄 |

| International Credit Card | 3.4% + 30垄 | 30垄 |

| PayPal Credit | 2.9% + 30垄 | 30垄 |

Merchandise and Services Fees

PayPal also charges Merchandise and Services (M&S) fees for certain types of transactions. These fees are typically higher than the standard transaction fees and can range from 2.9% to 6.5% plus a fixed fee of 30 cents per transaction. The M&S fees are applied to transactions involving digital goods, subscriptions, and recurring payments.

PayPal Credit

PayPal Credit is a line of credit offered by PayPal. When you use PayPal Credit to make a purchase, PayPal earns interest income on the amount you borrow. The interest rate on PayPal Credit varies depending on the customer’s creditworthiness and can range from 14.99% to 24.99% APR.

PayPal Here

PayPal Here is a mobile point-of-sale (POS) system that allows businesses to accept payments using their smartphones or tablets. PayPal Here charges a flat rate of 2.7% per swipe, dip, or tap transaction. This service provides an additional revenue stream for PayPal, as businesses pay for the convenience of using the service.

PayPal Payouts

PayPal Payouts is a service that allows businesses to send money to their customers. PayPal charges a fee for this service, which is typically 1% of the total amount paid, with a minimum fee of $1. This fee helps PayPal cover the costs associated with processing and distributing the funds.

PayPal’s Acquisition Strategy

PayPal has also expanded its revenue streams through acquisitions. By acquiring other companies, PayPal gains access to new markets and customer bases. For example, PayPal’s acquisition of Venmo in 2013 provided a popular peer-to-peer payment service, while the acquisition of iZettle in 2018 allowed PayPal to enter the mobile POS market in Europe.

Conclusion

In summary, PayPal generates revenue through various channels, including transaction fees, Merchandise and Services fees, interest income from PayPal Credit, fees for PayPal Here, and PayPal Payouts. Additionally, PayPal’s acquisition strategy has helped the company diversify its revenue streams and expand its market presence.