Understanding the Basics of Cash Flow 2.0

Cash flow is a critical aspect of any business, and with the advent of Cash Flow 2.0, managing and analyzing your cash flow has become more efficient and comprehensive. In this article, we will delve into the concept of Cash Flow 2.0, its components, and how it can benefit your business.

What is Cash Flow 2.0?

Cash Flow 2.0 is an advanced system that not only tracks your cash inflows and outflows but also provides insights into the health of your business. It goes beyond the traditional cash flow statement by incorporating various factors that affect your cash position.

Components of Cash Flow 2.0

Cash Flow 2.0 consists of several key components that help you gain a comprehensive understanding of your cash flow:

| Component | Description |

|---|---|

| Operating Cash Flow | Represents the cash generated from your core business operations. |

| Investing Cash Flow | Reflects the cash used for purchasing or selling long-term assets. |

| Financing Cash Flow | Includes cash flows related to financing activities, such as loans, dividends, and stock issuances. |

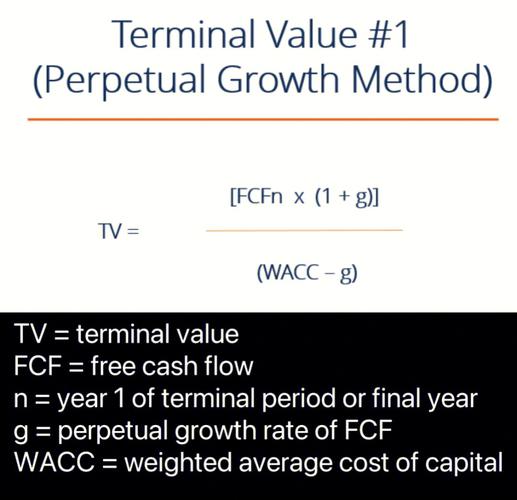

| Free Cash Flow | Represents the cash available to the business after accounting for capital expenditures. |

Benefits of Cash Flow 2.0

Implementing Cash Flow 2.0 in your business can offer several benefits:

-

Improved cash management: By having a clear understanding of your cash flow, you can make informed decisions about managing your cash reserves and expenses.

-

Enhanced financial forecasting: Cash Flow 2.0 provides you with the data needed to forecast future cash flow, helping you plan for potential shortfalls or surpluses.

-

Increased profitability: By optimizing your cash flow, you can identify areas where you can reduce costs and increase revenue.

-

Enhanced decision-making: With a comprehensive view of your cash flow, you can make more informed decisions about business investments and growth opportunities.

Implementing Cash Flow 2.0

Implementing Cash Flow 2.0 in your business involves the following steps:

-

Choose the right software: There are various software solutions available that can help you manage your cash flow effectively. Select a tool that meets your business needs and integrates well with your existing systems.

-

Track your cash flow: Regularly update your cash flow records, including all cash inflows and outflows. This will help you maintain an accurate and up-to-date picture of your cash position.

-

Analyze your cash flow: Use the data you have collected to analyze your cash flow and identify trends, patterns, and areas for improvement.

-

Make informed decisions: Use the insights gained from your cash flow analysis to make informed decisions about your business operations, investments, and growth strategies.

Conclusion

Cash Flow 2.0 is a powerful tool that can help you manage and optimize your cash flow. By understanding its components and benefits, you can implement Cash Flow 2.0 in your business and gain a competitive edge in the market.