Understanding Instant Payout Apps

Instant payout apps have revolutionized the way we manage our finances. These apps allow users to receive money instantly, without the need to wait for traditional banking processes. In this article, we will delve into the details of instant payout apps, exploring their features, benefits, and how they work.

How Instant Payout Apps Work

Instant payout apps operate by connecting users to financial institutions that offer real-time payment services. When you receive money through one of these apps, the funds are transferred directly to your bank account or a digital wallet. This process is typically faster than traditional bank transfers, which can take several days to complete.

Here’s a step-by-step breakdown of how instant payout apps work:

- You receive money through a payment method such as a credit card, debit card, or bank transfer.

- The instant payout app processes the payment and verifies the transaction.

- The app then transfers the funds to your bank account or digital wallet.

- You can access the funds immediately, without any waiting period.

Benefits of Instant Payout Apps

Instant payout apps offer several benefits that make them a popular choice for many users:

- Speed: The primary advantage of instant payout apps is their speed. You can receive money almost instantly, which is particularly useful in emergency situations or when you need funds quickly.

- Convenience: These apps are easy to use and accessible from anywhere, as long as you have an internet connection.

- Security: Many instant payout apps use advanced security measures to protect your financial information and prevent fraud.

- Accessibility: These apps are available to users in various countries, making it easier for people to receive money from friends, family, or clients around the world.

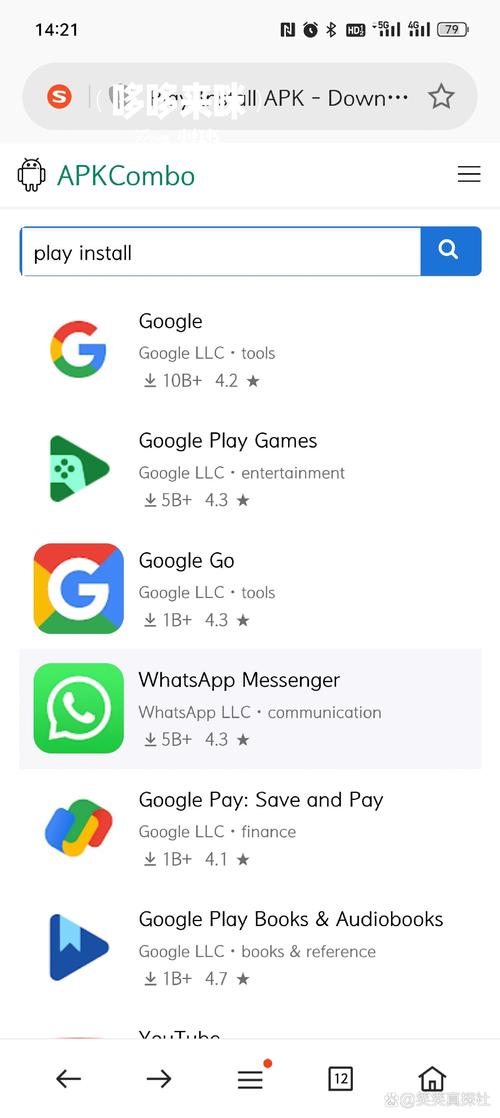

Popular Instant Payout Apps

Several instant payout apps have gained popularity due to their reliability and ease of use. Here are some of the most well-known apps:

| App Name | Country of Origin | Key Features |

|---|---|---|

| PayPal | United States | Secure money transfers, digital wallet, and mobile payment options. |

| Western Union | United States | Money transfers, bill payments, and mobile money services. |

| MoneyGram | United States | Money transfers, bill payments, and mobile money services. |

| Alipay | China | Mobile payment, online payment, and money transfers. |

| WeChat Pay | China | Mobile payment, online payment, and money transfers. |

How to Choose the Right Instant Payout App

With so many instant payout apps available, it can be challenging to choose the right one for your needs. Here are some factors to consider when selecting an instant payout app:

- Transaction Fees: Some apps charge fees for transferring money, while others do not. Make sure you understand the fees associated with the app you choose.

- Security: Look for apps that offer strong security measures, such as encryption and two-factor authentication.

- Accessibility: Choose an app that is available in your country and supports the payment methods you use.

- Customer Support: Make sure the app offers reliable customer support in case you encounter any issues.

Conclusion

Instant payout apps have made it easier than ever to manage your finances and receive money quickly. By understanding how these apps work and choosing the right one for your needs, you can take advantage of the many benefits they offer.